Ohio Sales Tax Rates 2025. Look up 2025 ohio sales tax rates in an easy to navigate table listed by county and city. Look up any cleveland tax rate and calculate tax based on address.

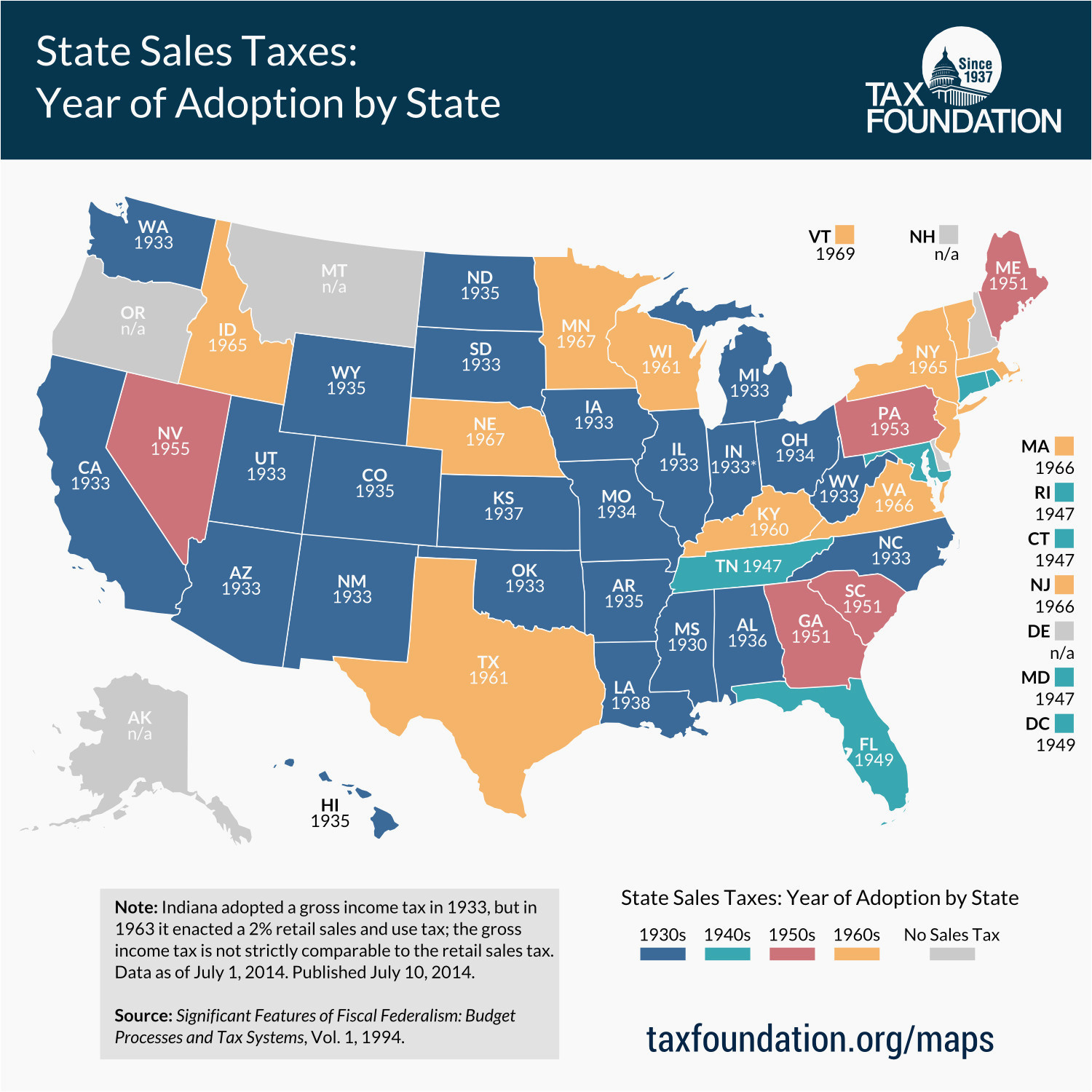

There were no sales and use tax county rate changes effective april 1, 2025. Ohio sales tax map legend:

There are a total of 576 local tax jurisdictions across the state, collecting an average local tax of 1.502%.

State Of Ohio Sales Tax Map secretmuseum, Free sales tax calculator tool to estimate total amounts. Look up any cleveland tax rate and calculate tax based on address.

State and Local Sales Tax Rates, Midyear 2025 Tax Unfiltered, The sales tax rate in ohio is a combination of a statewide base rate and potential additional local rates. The state sales tax rate in ohio in 2025 is 5.75%.

Compare property tax rates in Greater Cleveland and Akron; many of, The base rate is currently 5.75%. For instance, if you sell a product for $100 in a location with a 7.5% sales tax rate, you would charge $107.50 ($100 for the item, plus $7.50 for ohio sales tax).

Ohioans are spending more money on taxable things this year, including, The tax data is broken down by zip code, and additional locality information (location, population, etc) is also included. The ohio sales tax rate is 5.75% as of 2025, with some cities and counties adding a local sales tax on top of the oh state sales tax.

.png)

Monday Map Combined State and Local Sales Tax Rates, There are a total of 576 local tax jurisdictions across the state, collecting an average local tax of 1.502%. What is the sales tax rate in franklin county?

Considerations for COVID19 Tax Relief in Ohio Sales Tax Helper, Then, identify the local sales tax rates, varying across counties, cities, and districts. 2025 ohio sales tax map by county.

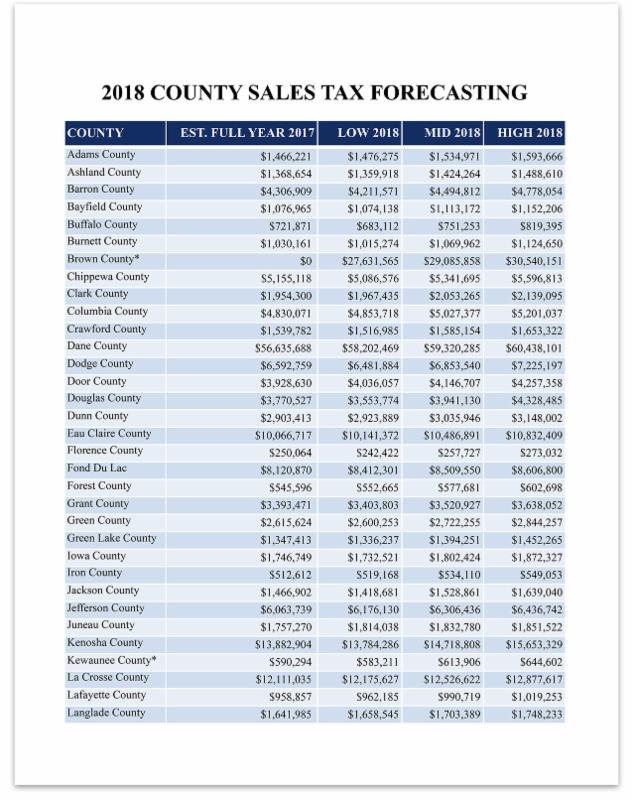

COUNTY SALES TAX FORECASTING, The minimum combined 2025 sales tax rate for franklin county, ohio is. The actual rate at which you pay sales tax in ohio will vary as the sales tax rate in ohio is based on the following formula:.

See how much Ohio's proposed tax cut would save you; details for, Then, identify the local sales tax rates, varying across counties, cities, and districts. The base rate is currently 5.75%.

Sales Tax Exempt Certificate Fill Online, Printable, Fillable, Blank, Calculating sales tax in ohio involves adding the tax rate by the sales price of the taxable product. The combined sales tax rate varies by location.

Sales Tax by State 2025 Wisevoter, The sales tax rate in ohio is a combination of a statewide base rate and potential additional local rates. A sample of the 1,412 ohio state sales tax rates in our.

Our free online ohio sales tax calculator calculates exact sales tax by state, county, city, or zip code.